In 2022, Tropical Disturbance TD03F that intensified into a tropical depression caused sustained winds and heavy rainfall. The tropical depression led to heavy rainfall in Fiji’s western, central, and eastern divisions. The estimated losses due to the event stood at FJD 100 million (USD 50 million). Smallholder farmers, fishers, and market vendors were among the most acutely impacted, given the vulnerable nature of their livelihoods and the lack of capacity to bear the financial impacts of weather-induced disasters.

In 2022, Tropical Disturbance TD03F that intensified into a tropical depression caused sustained winds and heavy rainfall. The tropical depression led to heavy rainfall in Fiji’s western, central, and eastern divisions. The estimated losses due to the event stood at FJD 100 million (USD 50 million). Smallholder farmers, fishers, and market vendors were among the most acutely impacted, given the vulnerable nature of their livelihoods and the lack of capacity to bear the financial impacts of weather-induced disasters.

In 2021, Fiji marked a milestone with the introduction of its first-ever parametric-based insurance. This initiative, led by local insurers, agriculture and farmer agencies, as well as mobile network operators, received support from the Pacific Insurance and Climate Adaptation Programme (PICAP). This multi-dimensional partnership helped accelerate claim payments through mobile money platforms during the tropical disturbance. However, the parametric insurance was designed to provide coverage for losses associated with rainfall and wind damage from cyclones. As a result, losses incurred due to tropical depressions (not classified as a cyclone) were excluded from the coverage. After one year of designing, testing, and finetuning the product, the Programme reflected on the future direction to take and realized the need to restructure the products to meet the needs of target population segments.

Parametric insurance and basis risk

Parametric insurance offers fast claims payouts through pre-agreed triggers or parameters and without the need for on-site verification of losses. This reduces administrative costs and improves the transparency of insurance products, leading to an efficient sign-up, trigger, and payment process. Despite its advantages, parametric insurance suffers from an inherent flaw — which is a mismatch between actual losses and predicted losses, known as basis risks. Basis risks not only affect the pricing of insurance products but also lowers the significance as consumers feel their needs were not adequately met the last time they qualified for a payment.

Basis risk arises from two distinct sources – zonal (idiosyncratic) risk, and design risk. The zonal (idiosyncratic) risks inherent to diverse groups – imply that the loss due to a particular event may impact one beneficiary more than another. Further, the risk is confined to either region or occupation. Due to its unsystematic nature, idiosyncratic risks are expensive to manage, and tackling them would impact the overall cost of insurance. To make insurance cost-effective, idiosyncratic risks are generally ignored, without impacting the overall cost of insurance. This is applicable, especially for a mass product designed for low and medium-income segments.

The design risk is caused due to the lack of deriving an optimal index that does not incorporate the covariant risk. The basis risk is minimized through robust product design backed by testing of contract parameters.

Tackling basis risk through stakeholder engagement

Designing index insurance involves ascertaining the essential parameters to target the key shocks that affect the financial resilience of the user. The quantitative model for designing parametric insurance requires actuaries to define additional parameters (trigger value, exit value, etc.) in order to set up the formula for a claim event and claim size, which are allowed to be based on single or on various weather indexes.

However, meeting the requirements of remote and diverse communities through index insurance products is an enormous challenge. Focusing on social equity helps to consider how social differences and associated inequalities may affect differently-capacitated people in the same disaster event. This requires the designers and implementers of index insurance to recognize a social (if not moral) responsibility to acknowledge the heterogeneity of communities, and actively consider the ground situation faced by the targeted beneficiaries.

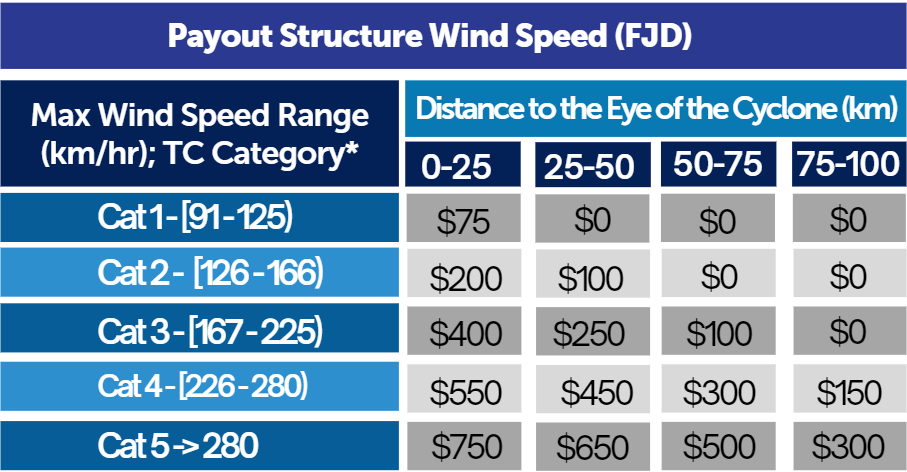

Reiterating the importance of stakeholder engagement to improve the insurance trigger points, UNCDF’s PICAP team reached out to end users through their grant partners, associations and cooperatives to understand the scenarios where beneficiaries did purchase insurance and suffered losses but did not receive the pay-outs. The UNCDF team realised that the target beneficiaries faced economic loss in case of continuous heavy rainfall despite the event not turning up as a cyclone or catastrophic event. The original parametric insurance covered heavy rainfall in case of Tropical Cyclones (TCs) falling in category 2 (refer to the figure below) and above.

Figure 1: Parametric insurance coverage (2021-2022)

Another insight from the data analysis of tropical cyclones occurring in Fiji highlighted the increased frequency of tropical depressions in the region, which do not convert to cyclones. These events caused damage to the fishing community, MSME owners, and growers. By developing a deeper understanding of the users’ contexts and preferences for parametric insurance, the PICAP and re/insurance providers evaluated and redesigned the coverage. The revised parametric insurance was designed to cover the losses arising due to high rainfall (continuous for a period of five days) using CHIRPS data. The new product provided cover against rainfall even if the event is not declared a tropical cyclone.

Along with Fiji, the PICAP took a similar approach to engage multiple stakeholders to design comprehensive coverage for parametric insurance in other Pacific countries.

The outcome of the product refinement was evident when the Western division of Fiji was affected by heavy rainfall in January 2023 which resulted in a trigger event. The rainfall cover ensured that beneficiaries were eligible for pay-outs. The insurers disbursed its first pay-out amounting to over FJD 100,000 (USD 50,000) via digital wallets and bank payments to 559 beneficiaries, of which 41% were women and 37% were persons with disabilities (PWDs). Subsequently, an additional 454 payouts were made amounting to FJD 101,000 (USD 50,500) for the excess rainfall events in February and March, mostly through mobile wallets (73%). In the same year, Vanuatu experienced two cyclones between the 1st and 5th of March 2023 (TC Judy & Kevin) which triggered cyclonic wind-related payments. The insurance resulted in 84 payouts amounting to over VT2.8 million (USD 25,000). More than 50% of these payments were done digitally, through bank accounts.

Learnings from PICAP experience

Unlike indemnity-based products, parametric insurance needs continual refinements to address the impacts of climate change which have resulted in intense and destructive events. The product refinement should further support the Pacific islands to develop its economic activities around the oceanic and coastal sectors. Even within the Pacific Islands, different countries have varied economic activities and hazard profiles implying tailor-made insurance products for each country. To ensure sustainability in the Programme, country-level stakeholders at the macro (government departments, regulators, etc.), meso (insurance providers, risk modeling agencies, banks, etc.), and micro (owners and associations of MSMEs, farmers, fishing community, etc.) level must appreciate the importance of product refinement and have adequate technical capacities to design, develop and refine the insurance-based solutions.

In this regard, the PICAP has already conducted studies on the protection gap in the Pacific countries to improve the financial preparedness of Pacific households, communities, and small businesses (MSME). It has developed and launched insurance products in Fiji (Aug 2021), Tonga (Nov 2022), and Vanuatu (Oct 2022). During the product development and roll-out stage, PICAP ensures it includes multiple stakeholders and builds their capacity for sustained business cases for insurance providers and aggregators, and value propositions for the insurance users.

PICAP has initiated the expansion phase will be from 2023 to 2025. It is proposed to cover more Pacific countries from the initial three- Fiji, Tonga, and Vanuatu and the countries for expansion include Samoa, Solomon Islands, Kiribati, Papua New Guinea, and Timor-Leste. In this direction, the PICAP has recently concluded in-depth scoping and feasibility for developing suitable climate disaster risk financing products and services for PNG.

PICAP is jointly implemented by the UN Capital Development Fund (UNCDF), UN Development Programme (UNDP), and UN University- Institute for Environment and Human Security (UNU-EHS).

The Programme receives financial support from the Governments of New Zealand, Australia, and the United Kingdom.

The Fiji component, ‘Scaling Climate Disaster Risk Financing Framework and Parametric Insurance’ project, receives exclusive funding from the Governments of Luxembourg (through the Drua Incubator) and India through the India-UN Development Partnership Fund, managed by the UN Office for South-South Cooperation.

Article by Praneel Pritesh, Regional Technical Specialist, Pacific Insurance and Climate Adaptation Programme, UNCDF; and Aneesh Gulati, Senior Manager, MicroSave Consulting. Originally posted by the United Nations Capital Development Fund (UNCDF). To access the original article, please click here.